Solutions

- Home

- Our Solutions

-

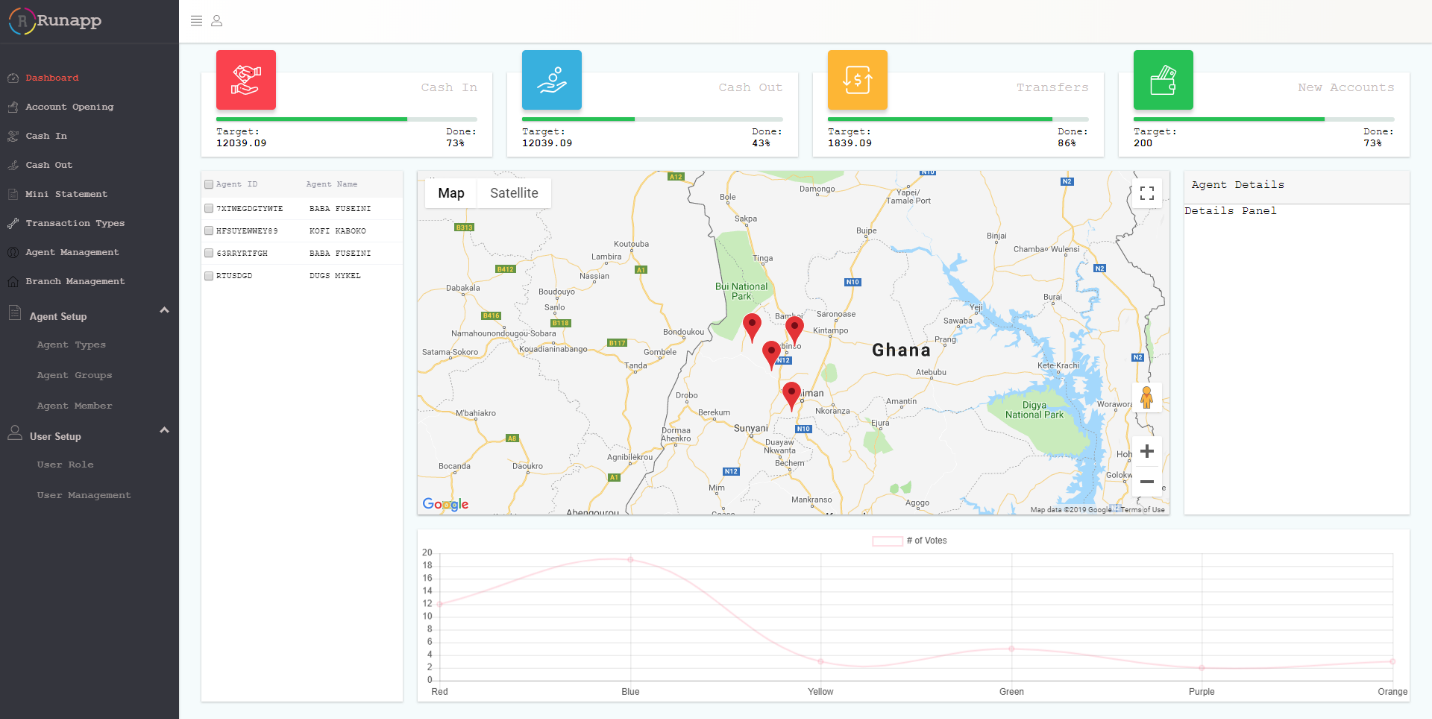

Agency Banking

RunApp’s Agency Banking is a fully fledged, easy to deploy application with an Agent Management Portal to give you geographical and performance view of your Merchants/ Agents. It empowers service providers to build an agent network that performs high volume, low value financial transactions on behalf of customers, such as Account opening, customer onboarding, deposits, withdrawals, bill payments, Airtime top-ups, interbank and intra bank transfers and remittances. As a multi lingual application, it is also supports PIN, OTP and biometric as means of authentication.

You want to request a demo? Click here.

-

Loan Application

This solution allows originating loans in the field using mobile devices. Validations and credit scoring can be embedded to the mobile application so that you can quickly give feedback to your clients. The field application works in both online and offline mode to ensure continuous availability in all areas of operation.

A web-based interface synchronizes with the field application to route the loans through your back office processes, providing a user friendly interface to aggregate all information relevant to the borrower's application.

You want to request a demo? Click here.

-

Digital Field Application

Using a mobile device, register details to support new client registration and account opening. Capture all required KYC information including photos, ID card and biometrics. Assures seamless integration with ID registries to support online validations and rules engine to automate approvals.

You can instantly issue cards associated with new accounts, linking card to customer via the mobile application. There is also an option to capture GPS location to support geographical mapping of customers and tracking of field staff.

Services supported:

- Account Opening

- Deposit

- Withdraw

- Loan Application

- Customer Onboarding

You want to request a demo? Click here.

-

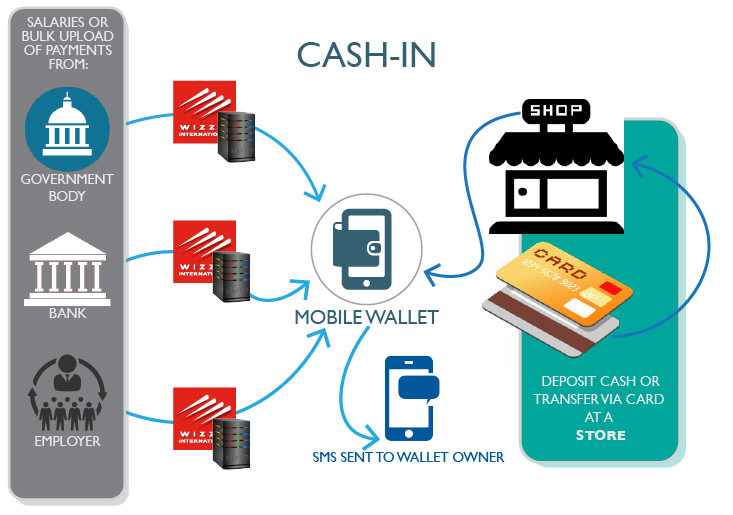

Mobile Wallet

A fully efficient virtual wallet with several funding sources, budgeting tools and unlimited online and offline e-payment capabilities. RunApp’s Mobile Wallet is a cutting-edge upgrade from the physical wallet that facilitates payments and commerce with simplicity and ease.

You want to request a demo? Click here.

-

CRM Application

Research has shown that companies that create satisfied, loyal customers have more repeat business, lower customer-acquisition costs, and stronger brand value—all of which translates into better financial performance.

RunApp’s CRM Application give a 360 Degree view of customer profitability, tracking Service Level Agreement performance.

This is built for the below Market Segment:

- Banks

- Microfinance Banks

- Credit Unions

- Insurance

- Apex Banks

You want to request a demo? Click here.

-

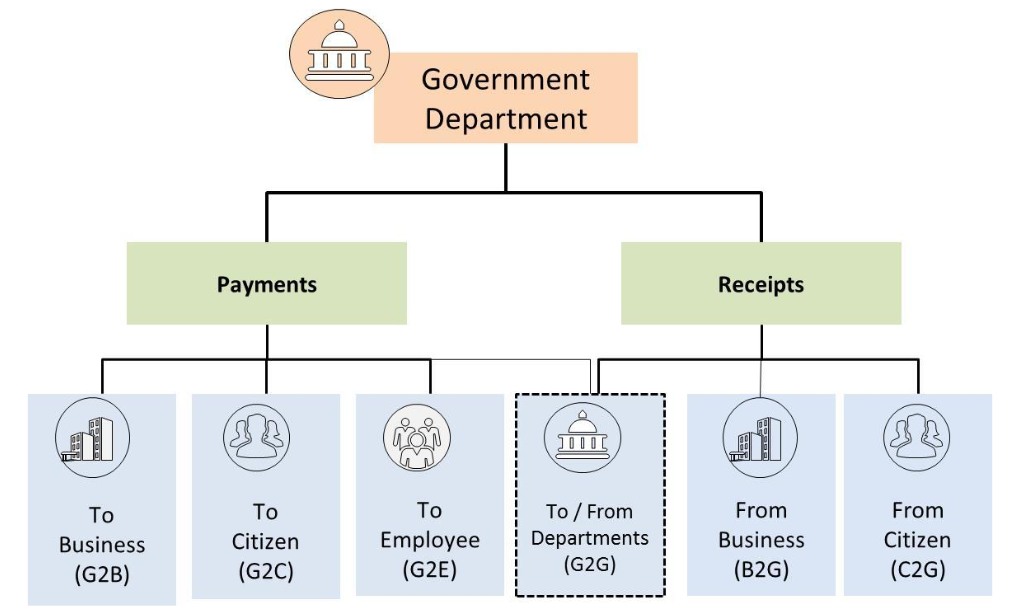

e-Government UP Platform

Government envisages web-enabled /mobile enabled anytime, anywhere access to information and services across the country, especially in rural and remote parts of their country and therefore envisages common e-Governance infrastructure that will offer end - to - end transactional experience for a citizen, businesses as well as internal government functions, which includes accessing various services through internet with payment gateway interface for online payments.

RunApp has hence prepared an Electronic Payment and Receipts framework, intended for State Governments, Government Autonomous Bodies, Central Public Sector Undertakings and Municipalities for expeditiously implementing appropriate mechanism to enable electronic payments and receipts.

RunApp’s eGovernment Shared Service acting as a centralized payment service that meets the highest industry security levels to provide citizens with a consistent and uniform experience while effecting payments online. The platform makes use of the provider-initiated online payments model.

When using this model, transactions are processed through a singular, centrally Hosted Payment Page (HPP). This method of payment ensures that Service Providers have no access to credit/debit card details submitted by citizens during an online payment process. The HPP is certified to be Payment Card Industry Data Security Standard (PCI DSS) compliant, a requirement mandated by all banks, and is the standard method for the processing of online payments through Government systems.

Integration to the service is facilitated by the provision of an Application Programming Interface (API) that provides a line of business applications and websites with the necessary functionality to:

Process an online payment – Allow clients to enter credit card details and complete a transaction.

Retrieve payment details – Verify payment by retrieving the status and all relevant information about the payment.

Refund processed payments – Refund functionality can be implemented to revert the funds back to the clients account.

Settle Payments – Settle Pre-Authorized Payments so that the funds are withdrawn from the clients account once a condition is met

Objectives of the e-Government Payment Platform:

1. Assess various services involving payments and receipts by types of services and level of electronic payment enablement.

2. Provide actionable instructions for universal adoption of electronic payment modes for each type of service through various payment channels.

3. Provide guidelines on engagement with various payment service providers

You want to request a demo? Click here.

-

e-Government Portal

Digital Application Platform for Government Services - Gov't to Citizens.

How does digitization of the Government Services bring sustainability to the entire business process?

Government Online Portal - A one-stop shop

for government-related informational Portal for- Citizens

- Government Agencies

- Investors

- Tourist

Financial Service:

- Payment vouchers

- Electronic Payments

- Tax Collection

- Filling Tax Returns

List of Government Agencies and Services

that can be supported using the RunApp Online Portal- Passport Office – All passport related services

- National Telecommunication Authority - Online Equipment Type Approval

- Online Recruitment Portal – Security Personnel, Civil Servants, Student Admission Portal, Job Application Platform

- Immigration Service – VISA Application, VISA Renewal

- Online Business Registration Portal for the Registry Department, Procurement Authority, Government Marketplace, National Housing Department

- Driver and Vehicle Registration Department – Driver License Application, Renewal, Vehicle Registration

Platform Access

- Web

- USSD

- Mobile App

- Social Media

You want to request a demo? Click here.